Is also mortgage forbearance sink your credit score?

If you have knowledgeable a short-term problem – such as for instance jobless, a career furlough, a divorce or separation, the fresh new death of children provider, problems or disability, or an organic crisis for example a beneficial tornado or hurricane – and you’re not able to create your month-to-month mortgage repayments getting a great limited time, usually do not worry. Even though many somebody instantaneously concern they’re going to default on the loan or believe property foreclosure is actually certain, it is not constantly thus cut and dry: there’s also forbearance.

What is forbearance?

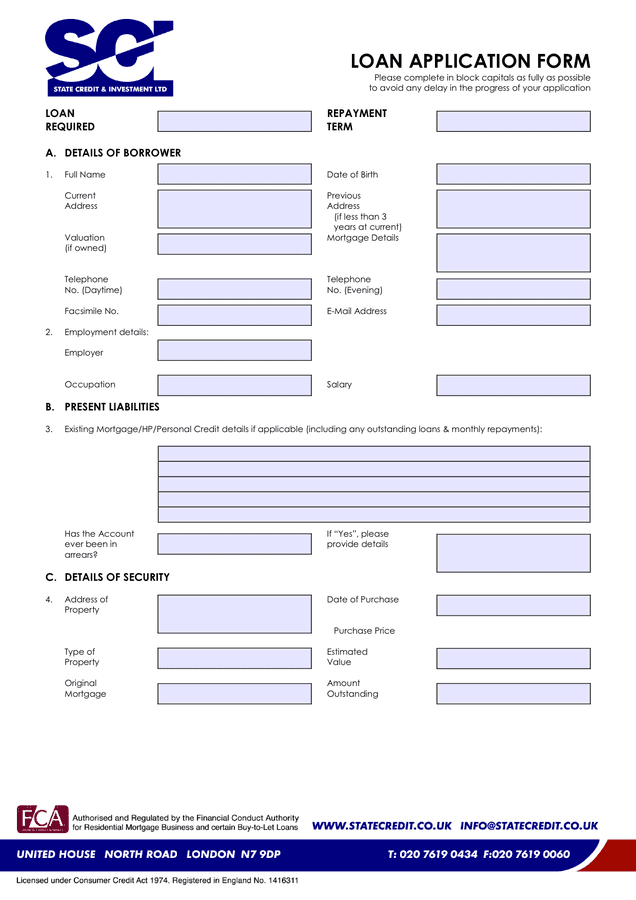

Mortgage forbearance are a short-name payment rescue contract you to definitely loan providers could offer borrowers who’re feeling a rough patch. Relief you are going to have been in the type of decreasing if you don’t pausing monthly premiums to prevent foreclosures. Consider, whether or not, in lieu of an even more long lasting loan mod, financial forbearance try temporary. It should be repaid subsequently if your pecuniary hardship is more than.

How does financial forbearance performs?

Brand new details of financial forbearance are normally taken for bank to help you bank, and it mostly relies on what sort of mortgage you may have, the length of time you have been and work out money, and precisely what the root activities try. Very mortgage forbearance terminology slide directly toward a couple of buckets, each of which happen to be intended to hold the bank of with to help you foreclose on your property. The two conditions were:

- their monthly payments will continue to be on a single plan, but feel reduced, or

- your own monthly obligations might be frozen entirely to possess a decided-upon months

You to last region is essential: the length of time usually the forbearance last?Read More »Is also mortgage forbearance sink your credit score?