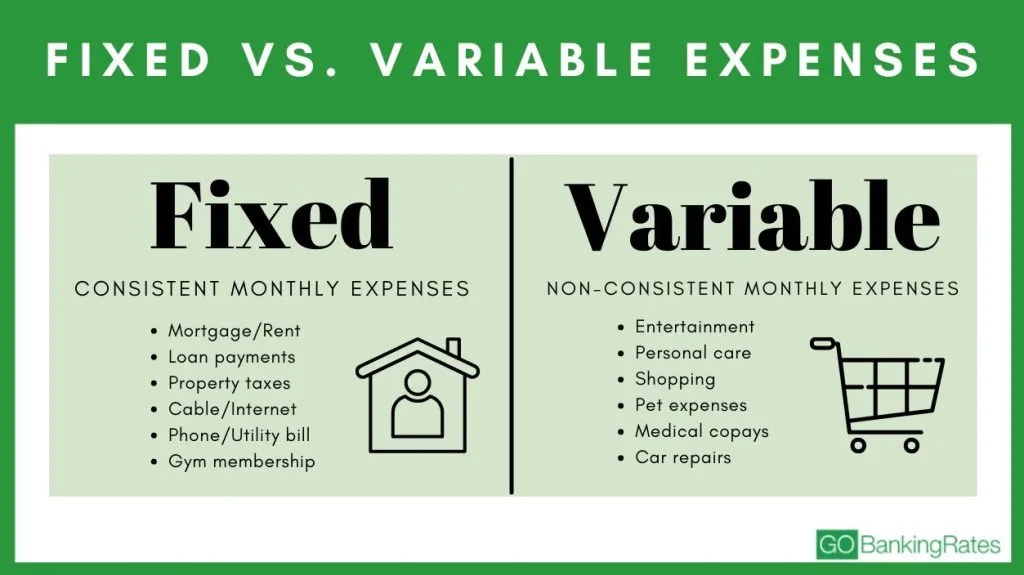

If you have adequate security, you could move the expenses in the brand new loan (meaning that boost the dominating)

cuatro. The expenses out-of Refinancing

Refinancing property always will set you back step three% so you can six% of the full loan amount, but individuals discover multiple an easy way to reduce the will set you back (or tie her or him to the financing). Certain lenders offer an effective no-cost refinance, which will means might shell out a slightly high notice speed to cover closing costs. Don’t neglect to discuss and comparison shop, as some refinancing fees shall be paid off by the lender or even shorter.

5. Cost versus. the expression

Even though many borrowers concentrate on the rate of interest, you should expose your goals whenever refinancing to determine and therefore home loan equipment suits you. If for example the objective is to decrease your monthly premiums normally you could, you will want financing into lower interest to possess new longest label.

If you’d like to shell out less attention along the period of the loan, pick a reduced rate of interest on quickest title. Individuals who want to pay their loan as quickly as you are able to should look having home financing into the smallest title you to demands repayments that they’ll afford. Home financing calculator can show the feeling various rates on your monthly payment.

6. Refinancing Affairs

When you compare various real estate loan now offers, make sure that you take a look at the rates of interest and you will the latest affairs. Points-comparable to step one% of your amount borrowed-are usually paid back to carry down the rate of interest. Make sure you assess exactly how much you’ll pay for the points with every loan, as these is paid down from the closure otherwise wrapped into the the principal of the the latest loan.

Lenders features tightened up their criteria to own mortgage approvals in recent times, requiring higher credit ratings to discover the best rates and lower DTI rates than in the past.Read More »If you have adequate security, you could move the expenses in the brand new loan (meaning that boost the dominating)