The ease in which you might qualify for property improvement financing would depend mainly on your own credit rating, most recent credit score in addition to sorts of financing you are looking to. The loan options will be much better if you an enthusiastic advanced credit rating. That being said, there clearly was alternatives for https://paydayloansconnecticut.com/knollcrest/ fair borrowing from the bank and less than perfect credit, but mortgage prices will normally vary according to these things.

Extremely unsecured loan lenders will charges high rates of interest when the you have a reduced credit history, many lenders will require one to meet with the minimum borrowing rating to be eligible for your preferred financing capital.

In the event your credit score is tricky, or if perhaps you really have fair credit now, you may have to settle for a less flexible loan arrangement, or perhaps be happy to undertake larger loan repayments. But not, it will be easy that greatest loan to you personally arises from a good borrowing relationship. It might also be really worth your own time to look for a keen online financial, or fixed interest levels.

Regardless of the your dream financing label turns out, your credit history and you may latest credit rating will establish just how available a knowledgeable do it yourself fund are for your requirements.

Try a house update mortgage safeguarded?

Typical home improvement funds are only personal loans that will be utilized having house renovations and you may fixes. These types of financing are unsecured. However, discover safeguarded loan alternatives for home improvements particularly a HELOC and you may Home Guarantee Financing. Such fund keeps increased minimum credit history qualification, and perhaps they are designed for the purchase and you can strengthening out-of residential property, including extreme refurbishment.

Private do-it-yourself funds generally speaking come with her selection of pros and cons, in comparison to this type of other types of secured personal loans.

Do you know the pros and cons of a home update mortgage?

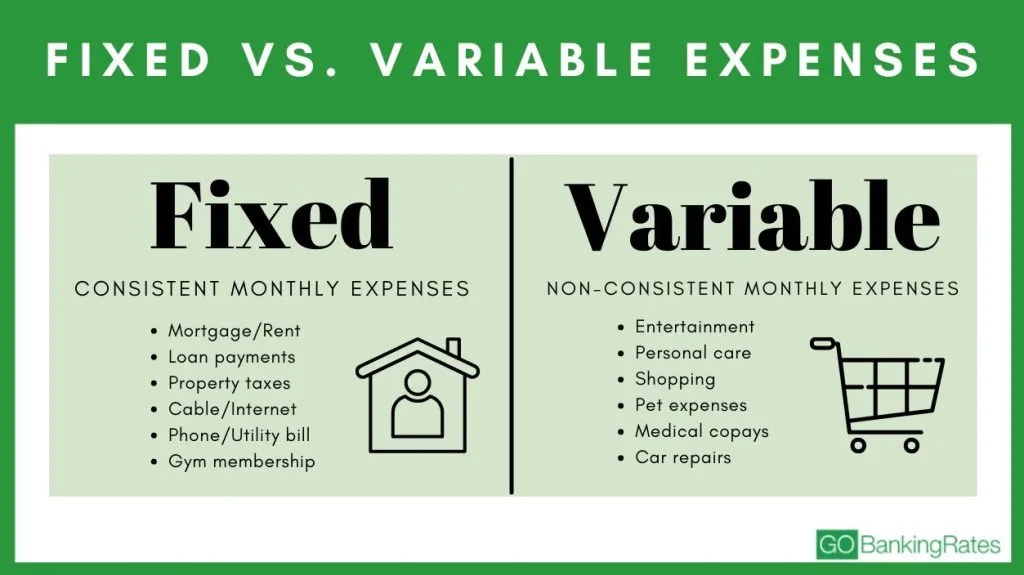

- Fixed Costs: Just like the signature loans feature repaired monthly payments, you could easily basis him or her in to your financial budget beforehand.

- Fast Money: The continues regarding a consumer loan will be distributed aside shorter than compared with most secured loans, so you can get become with the solutions otherwise updates without delay.

- No Collateral: Unsecured personal loans do not require guarantee, definition you don’t have to value the financial institution overpowering property in case of default costs.

- Highest Rates: Given that loan try unsecured, financing prices are usually relatively high to pay on the enhanced exposure for the lending company.

- No Tax Advantages: Individual unsecured loans are not qualified to receive income tax deductions, very recouping the expense of the loan is more challenging.

- Paid off due to the fact Lump sum: These types of funds was paid in one to lump sum payment, which means that you have got to finances accurately ahead of time and you will manage one to 1st contribution.

Is also a house update financing increase my personal residence’s worth?

As we will never see without a doubt whether or not home improvements commonly increase the worth of all of our assets, there are two main trick questions which will help you score personal so you’re able to a reply. Very first, will be your house badly needing solutions or updates? If so, and come up with people improvements you will carry it closer to average sector valuation. Furthermore, exactly how extreme are the upgrades you’re planning to make?

Home improvement funds could easily improve the property value your home, with regards to the extent and you may top-notch work. Short kitchen otherwise appliance upgrades, otherwise enhancements so you can gates, windows and you can Cooling and heating, are all types of seemingly minor updates and tend to be unrealistic to help you lead to one actual increase in the worth of a property.

Although not, major family repair tactics like total kitchen refurbishment, cellar conversions if not incorporating a solid wood platform can potentially raise the value of your home. At the least they must make your home more desirable so you’re able to potential buyers, that’s higher if you are searching to market short, otherwise flourish in a competitive field.